Scams are becoming more common, and some of the most convincing ones are impersonation or imposter scams. In 2024, consumers reported losing $2.95 billion to this type, second only to investment scams ($5.7 billion).

In imposter scams, criminals pretend to be from trusted businesses, such as your credit union, or impersonate individuals you know (like a friend or family member), to deceive and manipulate you for financial gain or personal information. Scammers may also claim to be from government agencies, law enforcement, or even tech companies. When carried out over the phone, this is called voice phishing, or “vishing.”

Recently, some of our debit card holders received phone calls from scammers pretending to be from our “Fraud Department” or “Fraud Center.” The scammers’ number even showed up on the caller ID as ours. That’s why it’s more important than ever to be aware of the tactics scammers use and how to protect yourself.

Key tips

Here are some ways, based on advice from the Federal Trade Commission (FTC) and us, to help you stay one step ahead:

Caller ID can be deceptive – Don’t trust it!

You might see our credit union’s name and/or number on your caller ID, but that doesn’t mean the call is legitimate. Scammers can use a technique called spoofing to make it look like they’re calling from a trusted number, even though they could be calling from anywhere in the world. If you’re ever unsure about a call, hang up and call us directly using the number you know is correct.

You can also try searching the number they called from online, but keep in mind that scammers can pay to have their fake numbers appear high up in Google search results, making them look legitimate. Just because it shows up at the top of a search doesn’t mean it’s real!

Be skeptical of unsolicited messages

Scammers often contact you out of the blue, whether it’s by phone, email, text, or even social media. They might claim they need money or personal information from you, and they often create a sense of urgency to pressure you into acting quickly. This is a red flag! If you ever get an unexpected message, don’t respond right away. Instead, reach out to us using contact info you’ve found yourself (not from the message they sent you).

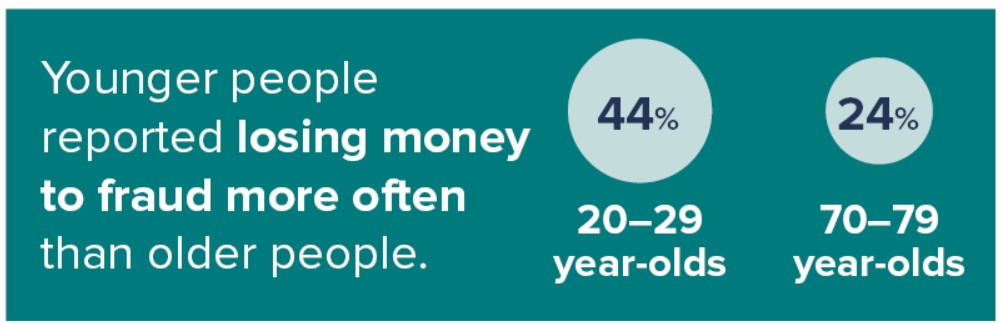

2024 FTC data

2024 FTC data

Keep your information safe

Scammers are out to trick you into giving up sensitive information so they can steal your money and/or identity. They want to gain access to your accounts, computer or phone. Don’t fall for their attempts.

We have an automated system in place that monitors your account and card activity. If any debit or credit card transactions are out of the ordinary, our processor will reach out to simply ask if you did them. They – or we – won’t ask for your card number, PIN (Personal Identification Number), account number, Social Security number, log-in credentials, or one-time password. Please don’t share sensitive information like this with scammers who will ask for it. If in doubt, don’t respond to the call, text, or email. Our processor automatically blocks the card if no one responds to the text, email, or phone call. You would just need to call our branch directly and speak with either Theresa, Amber, or Becky to resolve the situation.

What to do if you’re targeted

If you think you’ve received a scam call, text, or email:

o Hang up or ignore the message.

o Do not click any links.

o Report it to Century Credit Union and the FTC (https://reportfraud.ftc.gov).

2024 FTC data

Scammers are clever, but with the right knowledge, you can outsmart them. By staying aware of common tactics like vishing and caller ID spoofing, and following these simple steps, you can protect yourself from falling victim to these scams. Stay safe out there!

2024 FTC data

Learn more

Vishing, smishing, and phishing – these may sound like strange names, but they’re all types of social engineering scams. Each uses different communication methods to trick people into revealing personal or sensitive information. Learn more about the differences in this article on our website.

We’d also like to share links to these helpful resources on the FTC’s website:

• How To Avoid a Scam | Consumer Advice

• How To Block Unwanted Calls | Consumer Advice

• How to Recognize and Report Spam Text Messages | Consumer Advice

• What To Do if You Were Scammed | Consumer Advice

• New FTC Data Show a Big Jump in Reported Losses to Fraud to $12.5 Billion in 2024

Shared Branches & ATMs

Shared Branches & ATMs Apply for a Loan

Apply for a Loan Extra Awards

Extra Awards